Biography Of Obi Emetarom (Age , Wife , Net Worth) – Appzone, a pan-African fintech software company that develops unique solutions for the banking and payments industries, has closed a $10 million Series A financing.

The fresh financing will accelerate investment in Appzone’s core technologies and launch a wave of new national expansions as the company works to build up a financial operating system aimed at fully digitizing and automating financial services throughout the continent.

Advertisements

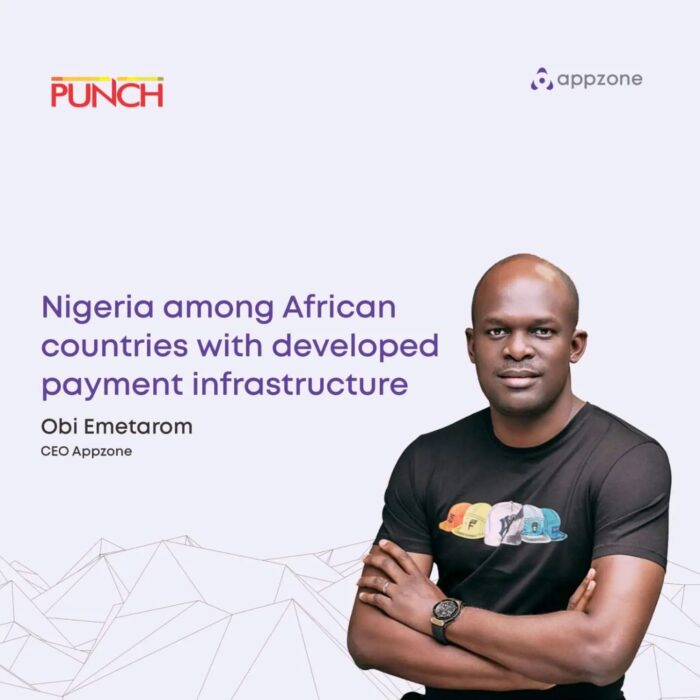

“We’re pleased not just to be obtaining a major capital raise but also welcome on board some strategic investors whose support will be critical to our development path,” said Obi Emetarom, the startup’s founder and CEO, in a statement. The announcement today enables us to swiftly grow Appzone’s products and services.”

Advertisements

Appzone solutions, according to Emetarom, assist conventional banks and fintech startups in Africa in dealing with the sector’s most urgent difficulties, such as legacy cost structures and a lack of operational efficiency, in the face of increased threats from telecom firms and big tech.

CardinalStone Capital Advisers led the investment round, which also included V8 Capital, Lateral Investment Partners, Constant Capital, and Itanna Capital Ventures.

Appzone, which was founded in 2008, provides best-in-class tools for digital core banking and interbank transaction processing to customers in seven African nations, including Access Bank, GT Bank, and Zenith Bank.

Appzone, a Google Launchpad Accelerator alumnus, has led Africa’s fintech sector through radical innovation, resulting in a number of world firsts from the continent, including the world’s first decentralized payment processing network, the first core banking and omnichannel software on the cloud, and the first multi-bank direct debit service based on single global mandates.

To date, Appzone’s systems have supported eighteen commercial banks and over 450 microfinance institutions, totaling $2 billion in annual transaction value and $300 million in annual loan distribution.

Appzone has clients in Nigeria, Ghana, Gambia, the Democratic Republic of the Congo, Tanzania, Senegal, and Guinea. Lateral Capital, GreenHouse Capital, Timon Capital, and Itanna contributed $15 million in equity capital.

The company received official approval from the Central Bank of Nigeria to operate as a Payment Solution Service Provider in 2018, and it has won a number of industry awards, including the Frost & Sullivan Award and awards from the National Association of Microfinance Banks and the Committee of eBusiness Industry Heads.

Advertisements

Be the first to comment